Horse Insurance – Eligibility

To qualify for the saving on your vet fee section of your horse insurance policy, your horse must be registered to the HHP at the time of purchasing the insurance. Your horse must remain on the programme for the duration of the policy, otherwise you will incur an additional excess on your vet fees of 10% of the claim (this is in addition to the fixed excess).

The level of vet fee cover your horse qualifies for is based on his value, age and the activities he is used for. For horses valued above £20,000, our specialist Sport Horse Insurance is available, unfortunately these policies are not eligible for the HHP scheme.

All horses and owners must be domiciled in the UK.

Horse Insurance – Cover Available

The following cover can be purchased under both a KBIS Leisure Policy and KBIS Competition Policy (with the exception of Permanent Loss of Use which is only available under our Competition policy.)

Please note the information below outlines the cover available, if you have a policy with KBIS your exact cover will be specified on your certificate of insurance.

Death,Theft and Straying

Death,Theft and Straying is the starting point of your insurance. It is the benefit paid following the death or euthanasia of the horse or if the horse is lost or stolen and not found. This benefit will be the sum insured/market value of the insured horse

Legal Expenses

As standard, KBIS horse insurance policies now include up to £50,000 per claim for Legal Expenses cover*. With a helpline available 24/7, 365 days a year, assistance can be provided for the following:

- Losses from injury to the horse and property damage whilst you are riding and caring for your horse (which is not otherwise covered by your insurance policy)

- Contract disputes over agreements entered into by you in relation to your horse (such during purchase or sale, loan, or the purchase or rent of facilities, land and stabling)

- Costs incurred for person injury which is the fault of another party whilst you are riding and caring for your horse

*Leisure and competition horse insurnace policies purchased on or after 1st September 2022

Vet Fee Cover

Vet fee cover provides the insured horse with cover for non routine veterinary procedures. Vet fee cover can be extremely beneficial and will help you to make sure your horse receives the veterinary attention required in the event of an injury without you, the horse owner, having to worry about the cost.

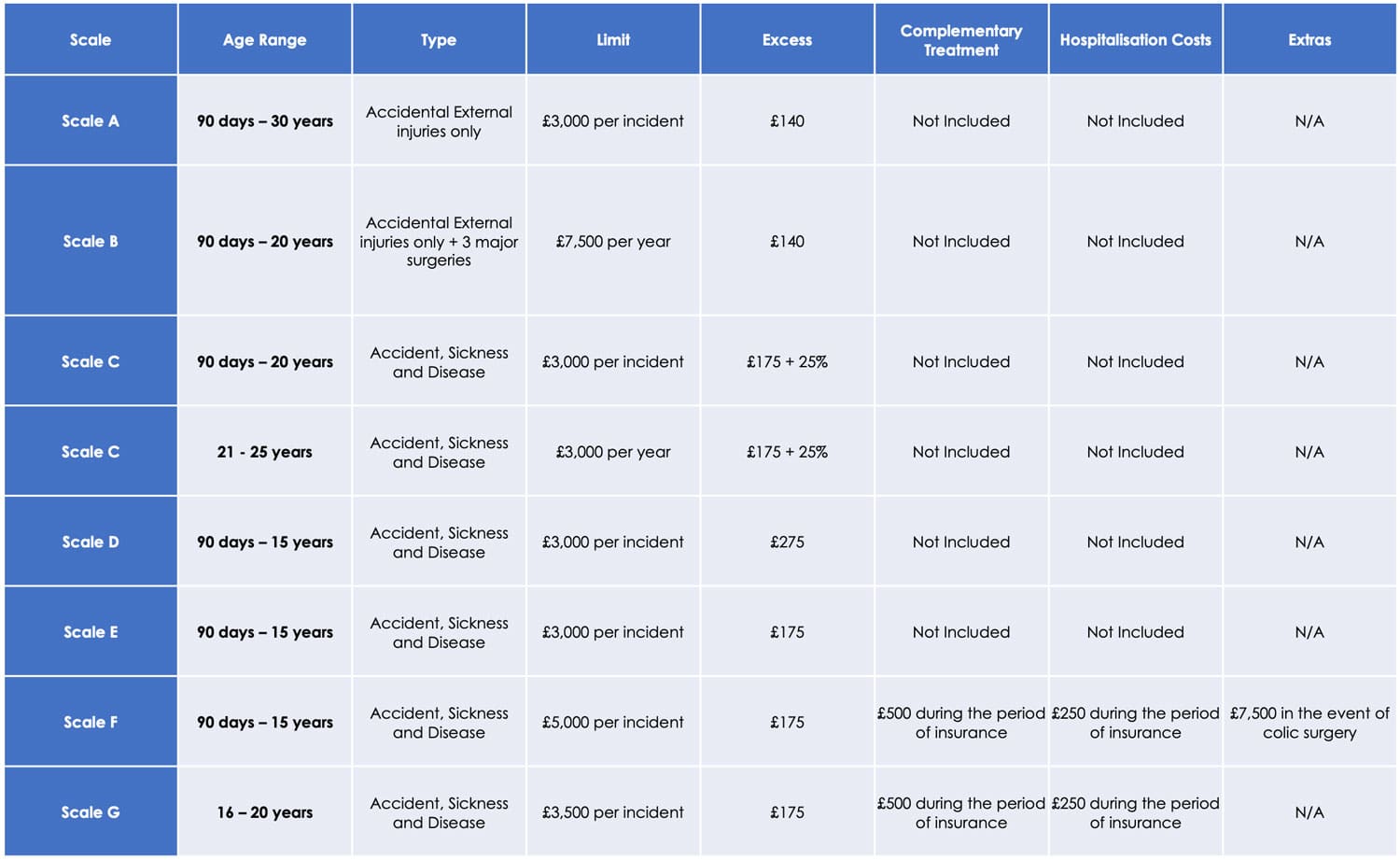

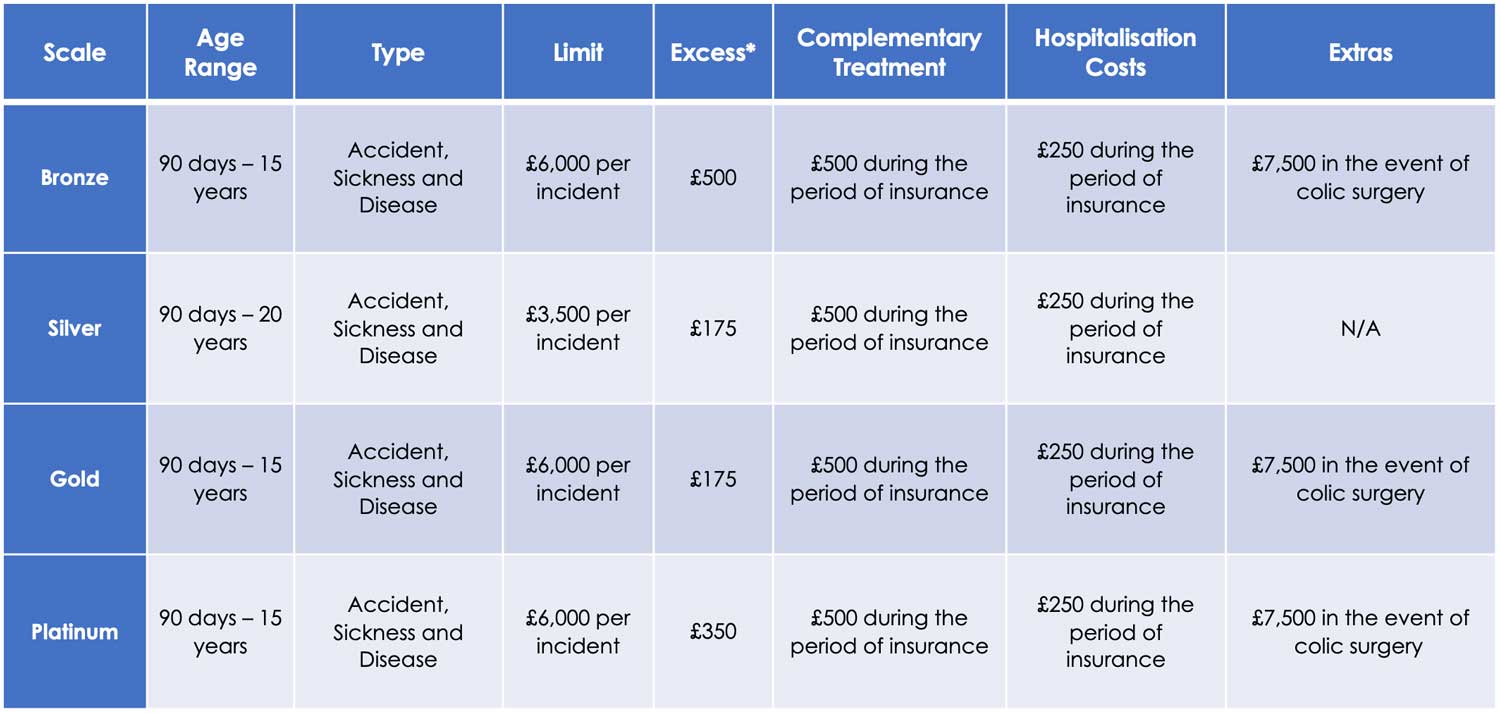

We offer a range of different vet fee cover options for you to choose from, depending on your horses age and the activities you are participating in.

Our Competition cover provides more comprehensive cover with incident limits up to £6,000, and cover for complementary treatment and hospitalisation. You can view the vet fee cover available under each policy below:

Permanent Loss of Use

(Available under our Competition cover only)

Permanent Loss of Use will provide cover if your horse sustains an injury or condition which in the opinion of both your own vet and the Underwriters vet means that the horse will no longer be able to fulfil the activity for which he is insured as stated on your certificate of insurance. You can choose to insure your horse for 100% or 75%.

Public Liability

Public Liability is one of the most important areas to consider taking out insurance. It provides the policy owner with cover against their liability to a third party, for example, if you were out hacking and your horse spooked and kicked a car causing an accident on the road. You can choose between three levels of cover, up to £1,000,000, £2,000,000, or £3,000,000.

Personal Accident

Personal Accident insurance covers you if you sustain a bodily injury through riding, handling, mounting or dismounting the insured horse. We can offer two levels of cover to choose from: Scale 1, which offers a benefit of £10,000; and Scale 2, which offers a benefit of £20,000.

Saddlery and Tack

We can provide cover for the physical loss or damage and theft of your tack in respect of the actual value at the time of loss but not exceeding the sum insured. Cover can be included for sums insured up to and including £10,000, with the excess £100 for each and every loss

Trailer/Horse Drawn Vehicle

You can choose to include your trailer (up to a value of £10,000) against physical loss or damage whilst immobilised and whilst being towed. The excess on this section is £100.

We can also provide stand-alone trailer insurance for values up to £20,000.

Horse Insurance – Policy Documents

Terms and Conditions

The Terms and Conditions outline the full details of cover available under the KBIS Leisure Policy, the KBIS Competition Policy and the KBIS B&W Equine Plan Policy.

Policies that started on or after 01/07/2022

Policies that started between 01/01/2022 and 30/06/2022

Insurance Product Information Document (IPID)

The IPID outlines the significant features, benefits, exclusions and limitations of the KBIS Leisure Policy, the KBIS Competition Policy and the KBIS B&W Equine Plan Policy. They do not contain the full Terms and Conditions.

Policies that started on or after 01/07/2022

Policies that started between 01/01/2022 and 30/06/2022

Archive

If your policy started before the dates above, then please visit our archive page to view the relevant Terms and Conditions, IPID’s and Key Facts.

Horse Insurance – Claim Forms

Online Claim Forms:

Downloadable/Printable Claim Forms:

- Veterinary Fee Claim Form

- Veterinary Fee Continuation Claim Form

- Mortality Claim Form

- Permanent Loss of Use Claim Form

- Theft Claim Form

- Tack Claim Form

- Trailer/Horse Drawn Vehicle Claim Form

- Personal Accident Claim Form

Should you need to make a claim on your policy it is important that you notify KBIS as soon as possible.

Please note that if you are intending to make a mortality claim, it is a condition of the policy that a post mortem examination is carried out and the report sent to KBIS.

The following guide will help to ensure that you have complied with the terms of your policy with regards to claims notification. It is important to adhere to these conditions as failure to do so may result in your claim not being paid.

1) Initial notification

Contact KBIS as soon as possible. You can contact KBIS by:

Phone:

UK Telephone No: 0345 345 2323

Outside UK: +44 (0) 1635 247474

View our office opening times.

Email:

ask@kbis.co.uk

2) Obtain a Claim Form

You can download the relevant claim form from the list above or alternatively if you have contacted our offices we can arrange for a form to be sent by post, including a free post envelope for the return of your form and documentation

3) Collate all necessary information

In order for us to process your claim in the most efficient manner it is important that we have all of the relevant documentation, as requested, to enable us and the underwriters to consider the claim in its entirety.

4) Send the completed claim for and documentation to KBIS

Please note that we are unable to give any indication whether a claim is likely to be paid without the completed claim form and invoices.

Horse Insurance – Vetting Requirements

The table below outlines our vetting requirements depending on the type of cover you wish to take out and the market value of your horse (not the value that you are choosing to insure the horse for).

For all levels of cover you will be required to complete a proposal form.

Mortality & Theft Cover only:

| Market Values up to £9,999 | None, unless you have had a pre purchase vetting carried out in which case you will need to send us a copy |

| Market Values £10,000 to £20,000 |

Vet Fee Cover:

| Market Values up to £6,000 | None, unless you have had a pre purchase vetting carried out in which case you will need to send us a copy |

| Market Values £6,001 to £9,999 | Two or Five stage vetting* unless the horse has been owned for a minimum of 6 months |

| Market Values £10,000 to £20,000 | Two or Five stage vetting* |

Permanent Loss of Use Cover:

| Market Values up to £9,999 | Five stage vetting* |

| Market Values £10,000 – £19,999 | Five stage vetting* plus X-rays. View x-ray requirements |

| Market Values £20,000 and above | Five stage vetting* plus X-rays. View x-ray requirements |

*Any vetting should have been carried out no more than 14 days before the start of the cover. If the vetting falls outside of this period then we would require a new vetting to be carried out in addition to seeing the original vetting.